25+ Calculate my loan payment

Youll also need to know the loans closing costs to calculate the break-even point where your savings from a lower interest rate exceed. PMI protects the lender in case you default on the loan.

Tables To Calculate Loan Amortization Schedule Free Business Templates

We were ignorant to the process.

. The principal loan amount. If you make weekly monthly or quarterly payments divide the annual rate by the number of payment periods per year as shown in this. Figure out 25 of your take-home pay.

This keeps you protected from the rising rates of an adjustable-rate loan. The amount you want to borrow to buy the car. Unless you come up with a 20 percent down payment or get a second mortgage loan you will likely have to pay for private mortgage insurance.

Understand the reason to calculate periodic payments on a loan. Instead it all appears in my name like i went to college. Subtract that interest from your fixed monthly payment to see how much in principal you will pay in the first month.

In that case the formula youd use. Use SmartAssets mortgage calculator above to estimate your monthly mortgage payment including your loans principal interest taxes homeowners insurance and private mortgage insurance PMI. Principal - The amount of the total paid that is not interest eg loan payment.

Never spend more than 25 of your monthly take-home pay after tax on monthly mortgage payments. Lets try to determine the monthly payment of a home loan. Nper - the total number of payment periods for the loan 60.

If you have a 5000 loan balance your first month of interest would be 25. Get the best deals on Car Loan at CarDekho. Public Bank Aitab Hire Purchase-i.

Now my daughter dont have. Lets calculate your costs if you have a 20000 loan with a 6 percent APR and a repayment term of 10 years. To calculate your DTI add all your monthly debt payments such as credit card debt student loans alimony or child support auto loans and.

When you take out a mortgage you agree to pay the principal and interest over the life of. For example if you make annual payments on a loan with an annual interest rate of 6 percent use 6 or 006 for rate. I have a son that wants to go to college but i dont have the money to make payments on the first loan.

Often lenders require that you make monthly or quarterly payments. How long youll be paying off your loan. Enter down payment amount in Malaysian Ringgit.

The annual interest rate r on the loan but beware that this is not necessarily the APR because the mortgage is paid monthly not annually and that creates a slight difference between the APR and the interest rate. This is the dollar value of the loan payment that is attributed to repaying the initial loan amount. To do this we set up CUMIPMT like this.

The total time the loan will be outstanding ie. Payment number - The payment number out of your total number of payments eg 1 6 etc. For this example we want to calculate the interest paid during each year in a 5-year loan of 30000 with an interest rate of 5.

The amount you will need to pay each month to pay off the loan by the end of the agreed-upon term. A portion of each payment is deducted for the lenders money rental fee interest portion and the remainder principal portion will be used to reduce the amount you owe. Your monthly interest rate Lenders provide you an annual rate so youll need to divide that figure by 12 the number of.

Interest - The amount of the total paid that is interest. Lets see how this might work in a worksheet. The loan is 30000.

With a 20 down payment on a 30-year mortgage and a 4 interest rate you need a household income of 70000 yearly or more before tax. Malaysia car loan calculator to calculate monthly loan repayments. Is my employer required to pay me for my last two weeks if the FFCRA has expired.

Hong Leong Auto Loan. Generate car loan estimates tables and charts and save as PDF file. Definition and Examples of Monthly Loan Payments.

I make 43000 my wife does not work. This is the dollar value of the loan payment attributed to repaying interest accrued on the loan. How much income you need depends on your down payment loan terms taxes and insurance.

Otherwise referred to as PI payment. Therefore it is more useful to know what the monthly or quarterly payment. We divide 5 by 12 because 5 represents annual interest.

Method 1 of 2. Type is an optional argument to define when the payment occurs. The cost of PMI varies greatly depending on the provider and the cost of your home.

In this case you would take the amount you borrowed and multiply it by your interest. Rate required - the constant interest rate per period. 0 or omitted tells the function the payment is at the end of each period and 1 means the beginning of the period.

The number of years t you have to. For example your card issuer might require that you pay at least 25 or 1 of your outstanding balance each month whichever is greater. The loan amount P or principal which is the home-purchase price plus any other charges minus the down payment.

Ultimately how much you need to make depends on your down payment loan terms taxes and insurance. Rate - The interest rate per period. So with a 20 down payment on a 30-year mortgage and a 4 interest rate youd need to make at least 90000 a year before tax.

We told the college that. I used 6 weeks of FFCRA leave between April 1 2020 and December 31 2020 because my childcare provider was unavailable due to COVID-19. When you take out a mortgage you agree to pay the principal and interest over the life of the loan.

If you plan to make a down payment or trade-in subtract that amount from the cars price to. The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. To calculate how much house you can afford use the 25 rule.

The total monthly mortgage payment. Extra Payment - The dollar amount of any extra payments you make. Calculating Annual Payments on a Loan.

Follow these simple steps to calculate your annual loan payment. Use our Car Loan Calculator to check monthly EMI on the basis of car price down payment interest rate loan tenure. A footnote on the payment schedule informs you of the rounding amount.

You can supply it as a percentage or decimal number. It was supposed to be my daughters loan. We are borrowing 200000 for 30 years at 4.

My employer allowed me to take time off but did not pay me for my last two weeks of FFCRA leave. Rounding Options - due to payment and interest rounding each pay period for example payment or interest might calculate to 3450457 but a schedule will round the value to 34505 almost all loan schedules need a final rounding adjustment to bring the balance to 0. Payment - The total amount paid.

Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. Your monthly payment will be higher with a 15-year. The monthly payment formulas calculate how much a loan payment will be and include the loans principal and interest.

Tables To Calculate Loan Amortization Schedule Free Business Templates

Pin On Everything Finance

2

Tables To Calculate Loan Amortization Schedule Free Business Templates

Pin On Agenda Ideas

2

Tables To Calculate Loan Amortization Schedule Free Business Templates

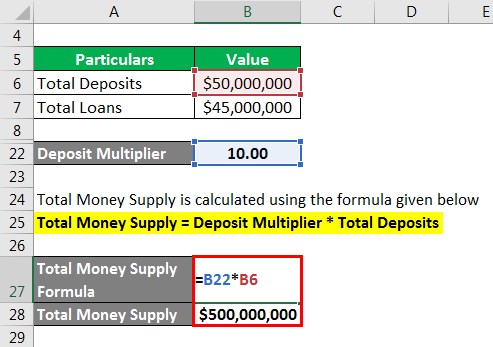

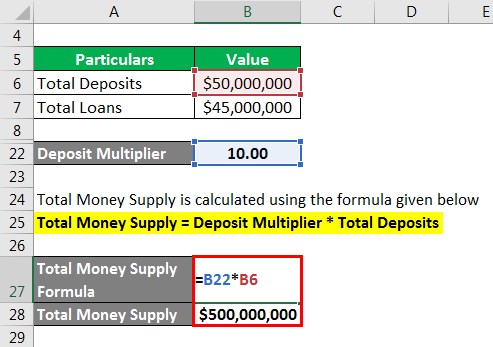

Multiplier Formula Calculator Example With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

Pin On Adulting Personal Finance Money Career Self Help

Pin On Bullet Journal

Pin On Everything Finance

Pin On Blogging Tips

Tables To Calculate Loan Amortization Schedule Free Business Templates

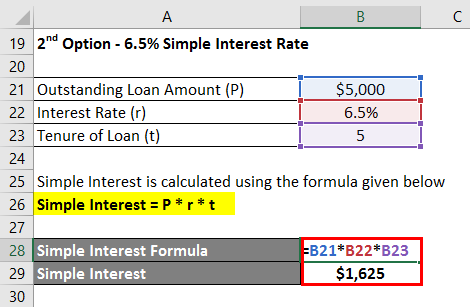

Interest Formula Calculator Examples With Excel Template

Maturity Value Formula Calculator Excel Template

The Fascinating Loan Application Rejection Letter 15 Sample Letters In Business Proposal For Bank Loan Te Letter Templates Lettering Business Letter Template