Ira payout calculator

Annuity payment options depend on the type of annuity purchased. Evaluate my company pension payout options.

Roth Ira Calculators

Our standard CD and IRA options are available to open at any Univest financial center.

. How much retirement income may an IRA provide. This calculator also provides a graph and schedule for each option. We see this mistake all the time.

8 min read Sep. Social Security benefits calculator. While the SECURE Act eliminated this stretch option in favor of the 10-year payout provision for non-spouse beneficiaries some beneficiaries could qualify for exceptions.

What will my qualified plans be worth at retirement. This calculator has slide bars that allow you to easily adjust the inputs but its best feature is the text below the graph. It is important that you re-evaluate your preparedness on an ongoing basis.

If you begin claiming at 62 youll get only 70 of your standard benefit if your FRA is 67 or 75 if your FRA is 66. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. Should I convert to a Roth IRA.

What is my projected required minimum distributions. Payout schedules determine the duration of. Every month you delay benefits increases your checks slightly until you reach.

Comparing mortgage terms ie 15 20 30 years. Retirement Savings Calculator Am I saving enough for my retirement. Should I convert to a Roth IRA.

Tax-advantaged retirement plans such as an IRA or 401k. How much can I contribute to an IRA. Use this calculator to determine what your hourly wage equates to when given your annual salary - it may surprise you what you make on an hourly basis.

Immediate annuities can payout within a year of purchase. IRA plans are held in high regard but how do they compare to a 401k. This lets us find the most appropriate writer for any type of assignment.

Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. Use this income annuity calculator to get an annuity income estimate in just a few steps. The 72t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty.

The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be withdrawn tax-free. How much can I contribute to an IRA. Should I convert to a Roth IRA.

What is my current year required minimum distribution. Once this number is clear its multiplied by the percentage factor for your plan. Example of Your Potential Pension Payout.

However most will use the average of your three highest years of compensation as a start for your payout calculations. Evaluate my company pension payout options. How much can I contribute to an IRA.

It provides quite a bit of additional detailed information. Children and Other Non-Spouse Beneficiaries. Evaluate my company pension payout options.

Less common qualified retirement plans include defined benefit pension plans 403bs similar to 401ks Keogh Plans Thrift. Also you may want to see if you have one of the 50 best jobs in America. Related Retirement Calculator Investment Calculator Annuity Payout Calculator.

Retirement can be the happiest day of your life. Evaluate my company pension payout options. CD is a savings tool used to accumulate interest for a fixed amount of time.

Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. It can also generate a PDF report. Evaluate my company pension payout options.

Every pension plan has different terms. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Use this calculator to help illustrate the total compensation package for an.

How much retirement income may an IRA provide. An RMD must be taken from each employer plan that you might have. Deferred annuities take years to payout as the tax-free annuity grows with interest.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset growth tax consequences and penalties based on information you specify. Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72t early distribution analysis. How much retirement income may an IRA provide.

Should I convert to a Roth IRA. How much can I contribute to an IRA. If a IRA 401k is in payout status and therefore an exempt asset the payout will still count as income towards Medicaid eligibility.

The rules for IRAs and 401ks also extend to 403bs Keoghs and TSAs. Still other states do not exempt retirement savings accounts regardless of payout status. Rules for Inheriting an IRA.

IRA is a type of account that offers tax-deferred growth until you make regular withdraws or reach retirement age depending on the type of IRA. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount. SCHWABS MINIMUM FOR ANNUITY CONTRACTS Designed to ensure we are operating at the highest possible service level there is currently a 100000 minimum for all annuity contracts offered through Schwab.

There is an exception for 403b plans. Lets say youre opting for monthly pension payments. This pre-retirement calculator was developed to help you determine how well you have prepared and what you can do to improve your retirement outlook.

How much can I contribute to an IRA. The employer has both required and discretionary payments that it makes on behalf of the employee. 72t Calculator by Bankrate.

You cannot take an employer plan RMD from an IRA or vice versa. How much retirement income may an IRA provide. SmartAssets retirement calculator can help you set up and plan your retirement goals.

If you have two 401ks and a 403b you must take 3 separate distributions one from each 401k and one from the 403b. Use this Social Security benefit calculator to estimate your amount of Social Security benefits. The tax advantage of the 401k is similar to that of a deductible IRA - its not so much that you get to defer taxes as that you pay less taxes periodUnlike a regularly-taxed account the 401k lets you get taxed just once rather than multiple times.

Standard CDs and IRAs.

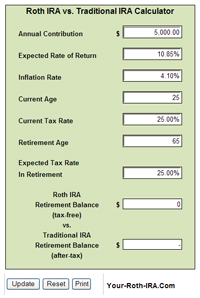

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Rmd Table Rules Requirements By Account Type

/ira-5bfc2faa4cedfd0026c1d618.jpg)

Can The Non Spouse Beneficiary Of An Ira Name A Successor Beneficiary

Traditional Vs Roth Ira Calculator

Required Minimum Distribution Calculator

Ira Withdrawal Calculator Factory Sale 52 Off Rikk Hi Is

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Required Minimum Distribution Calculator Estimate Minimum Amount

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Best Roth Ira Calculators

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator

Retirement Withdrawal Calculator For Excel

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Roth Ira Calculator Roth Ira Contribution